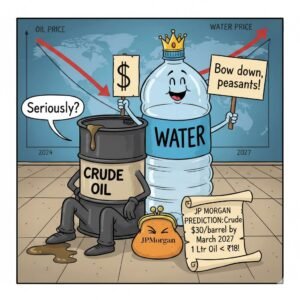

The price of crude oil in the international market could be lower than the price of a liter of water. We are not kidding. This prediction has been made by the world’s leading brokerage firm, JP Morgan. The firm has estimated that the price of crude oil could touch $30 per barrel by the end of the 2027 financial year, i.e. March 2027. If this is translated into Indian rupees, and at an exchange rate of 1 dollar to 95 rupees, then a barrel of crude oil would cost 2850 rupees. This means that the price of a liter of crude oil would drop by 18 rupees.

Currently, the price of water is between 18 and 20 rupees. It could increase further in the next one and a half years. If this prediction proves true, then even if the Indian rupee falls to 100 rupees against the dollar, the Indian government will have the flexibility to reduce the prices of petrol and diesel. Currently, Brent crude oil, the crude oil produced in the Gulf, is trading above $62 but below $63 per barrel. According to JP Morgan’s forecast, crude oil prices could fall by more than 50 percent in the next 16 months. Let’s explain the American powerhouse’s forecast.

Crude oil prices could fall to $30.

JP Morgan has made a significant prediction regarding crude oil prices. This could be important news for countries that rely solely on imports globally. JP Morgan has estimated that Brent crude oil prices could fall to $30 per barrel by the end of fiscal year 27 or March 2027. This means that Brent crude oil prices are likely to fall by more than 50 percent from their current levels.

According to JPMorgan, the main reason for this potential decline will be the increase in global supply, which could far outstrip demand. The investment bank’s latest forecast suggests that despite continued growth in oil consumption over the next three years, supply will continue to grow. This supply, particularly from non-OPEC+ countries, will significantly impact energy markets and put pressure on prices.

How much demand and how much will it increase?

Global oil demand is expected to grow by 0.9 Mbd in 2025, bringing total consumption to 105.5 Mbd. Growth is projected to remain flat in 2026 and increase to 1.2 Mbd in 2027. However, this steady growth is unlikely to keep pace with supply, which JPMorgan estimates will grow by almost three times the rate of demand in both 2025 and 2026. However, the supply increase in 2027 will reduce prices. However, it will be much higher than the natural capacity of the market.

Prices could reach $30

Such an imbalance means that Brent could fall below $60 in 2026 and fall to $50 by the last quarter, to $50 by the end of the year. By 2027, the average price could fall to $42, reaching $30 by the end of the year. However, JP Morgan says that the supply reduction can be used to rebalance prices. Prices are unlikely to reach $30. Brent crude oil could reach $58 a barrel in 2026, from around $60 now. Currently, Brent is trading above $60 a barrel.

So Brent crude oil would be cheaper than water.

If JP Morgan’s prediction comes true, then the price of a liter of crude oil could be less than a liter of water. Let us try to explain this with an example. JP Morgan has estimated that the price of crude oil will reach $30 per barrel by the financial year 2027. If we translate this into Indian rupees, the rupee is currently worth 89 against the dollar. However, the exchange rate will also change by March 2027. According to one estimate, the rupee could reach 95 against the dollar by March 2027. This means that the price of a barrel will be Rs 2080 per barrel. A barrel contains 159 liters. This means that the price of a liter of crude oil will be Rs 17.90. Currently, a liter of water in the national capital Delhi costs Rs 18 to 20. This means that the price of crude oil could be cheaper than water.

Petrol and diesel to become cheaper in India

The main point is that if crude oil prices reach $30 per barrel, then India will benefit a lot. Along with this, the common man will be able to get cheaper petrol and diesel. Currently, crude oil is available at $62 per barrel. However, due to the depreciation of the rupee, even that oil is becoming expensive for India. Currently, Brent crude oil costs more than Rs 5,600 per barrel. By 2027, the rupee will depreciate to Rs 100 against the dollar, when India will have to spend only Rs 3,000 per barrel, which could be more than Rs 2,600 less than the current level. According to the Indian government and petroleum companies, this will help reduce the price of petrol and diesel.